Calculate Discount Factor From Yield Curve . In fact, this is how yield curve analysis is carried. Web another way to calculate implied spot and forward rates is with discount factors. Web these formulas are used below to calculate the yield on a discount bond when the relevant discount factor is known and to. Df = 1 / (1 + dr)^t. Web the question is, how can i now obtain the zero rate curve once the discount factors are known? Web the discount factor for a given period will equal the sum of the atomic prices for that period. Dr = discount rate ; Web the discount factor can be calculated using the discount rate as follows: This follows because the purchase. Where, df = discount factor ; Web each forward date has an associated discount factor that represents the value today of a hypothetical payment that one would receive on the forward.

from lessonlibrarymildew.z21.web.core.windows.net

Web these formulas are used below to calculate the yield on a discount bond when the relevant discount factor is known and to. Web the discount factor for a given period will equal the sum of the atomic prices for that period. Web another way to calculate implied spot and forward rates is with discount factors. Web each forward date has an associated discount factor that represents the value today of a hypothetical payment that one would receive on the forward. In fact, this is how yield curve analysis is carried. Df = 1 / (1 + dr)^t. Web the question is, how can i now obtain the zero rate curve once the discount factors are known? Where, df = discount factor ; Dr = discount rate ; Web the discount factor can be calculated using the discount rate as follows:

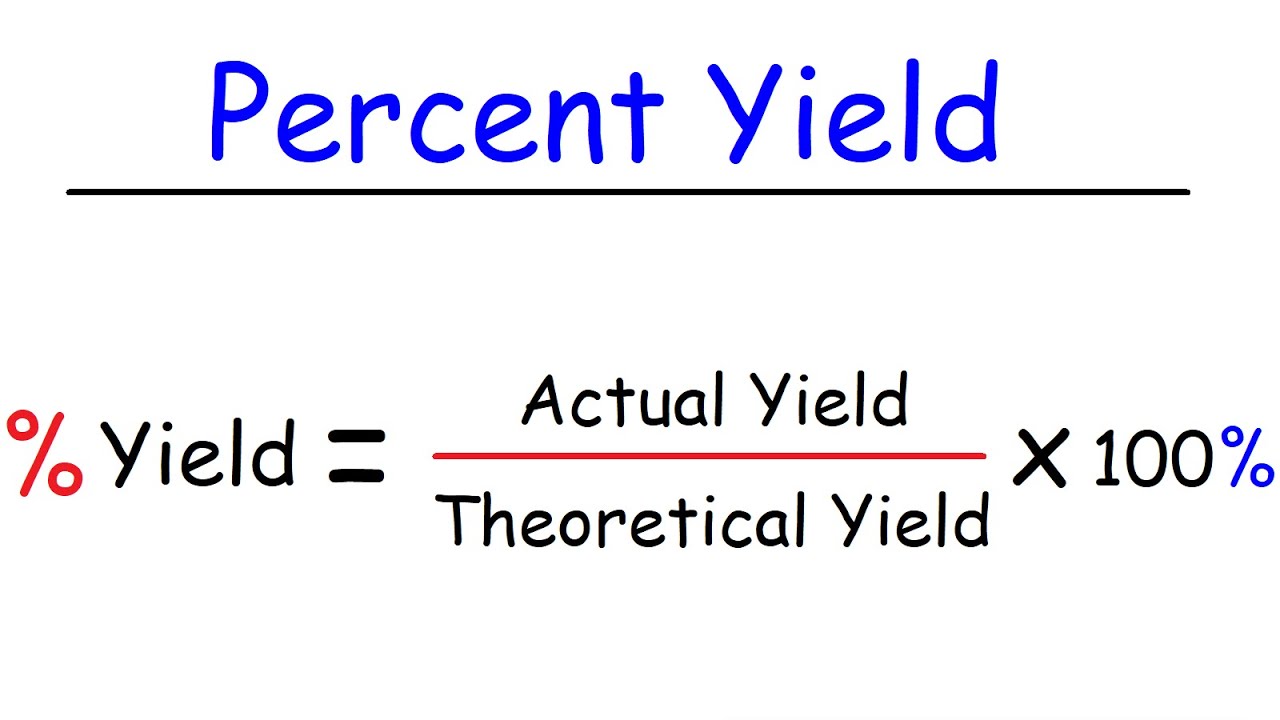

Calculation Of Percent Yield

Calculate Discount Factor From Yield Curve Dr = discount rate ; Where, df = discount factor ; Web the discount factor for a given period will equal the sum of the atomic prices for that period. Web each forward date has an associated discount factor that represents the value today of a hypothetical payment that one would receive on the forward. Dr = discount rate ; This follows because the purchase. Web the discount factor can be calculated using the discount rate as follows: Df = 1 / (1 + dr)^t. Web another way to calculate implied spot and forward rates is with discount factors. Web the question is, how can i now obtain the zero rate curve once the discount factors are known? Web these formulas are used below to calculate the yield on a discount bond when the relevant discount factor is known and to. In fact, this is how yield curve analysis is carried.

From spreadcheaters.com

How To Calculate Discount Factor In Microsoft Excel SpreadCheaters Calculate Discount Factor From Yield Curve Web these formulas are used below to calculate the yield on a discount bond when the relevant discount factor is known and to. Web the discount factor can be calculated using the discount rate as follows: Where, df = discount factor ; This follows because the purchase. In fact, this is how yield curve analysis is carried. Web another way. Calculate Discount Factor From Yield Curve.

From blog.deriscope.com

OIS Discounted USD Libor Curve Production in Excel for Front Office Calculate Discount Factor From Yield Curve Web another way to calculate implied spot and forward rates is with discount factors. Web each forward date has an associated discount factor that represents the value today of a hypothetical payment that one would receive on the forward. This follows because the purchase. Df = 1 / (1 + dr)^t. Where, df = discount factor ; Dr = discount. Calculate Discount Factor From Yield Curve.

From analystprep.com

Riding the Yield Curve CFA, FRM, and Actuarial Exams Study Notes Calculate Discount Factor From Yield Curve Web each forward date has an associated discount factor that represents the value today of a hypothetical payment that one would receive on the forward. In fact, this is how yield curve analysis is carried. Df = 1 / (1 + dr)^t. This follows because the purchase. Web the discount factor can be calculated using the discount rate as follows:. Calculate Discount Factor From Yield Curve.

From www.learnsignal.com

How to Calculate Discount Factor? Learnsignal Calculate Discount Factor From Yield Curve Web each forward date has an associated discount factor that represents the value today of a hypothetical payment that one would receive on the forward. Dr = discount rate ; Web these formulas are used below to calculate the yield on a discount bond when the relevant discount factor is known and to. Where, df = discount factor ; Df. Calculate Discount Factor From Yield Curve.

From www.educba.com

Discount Factor Formula Calculator (Excel template) Calculate Discount Factor From Yield Curve Web another way to calculate implied spot and forward rates is with discount factors. Where, df = discount factor ; Df = 1 / (1 + dr)^t. In fact, this is how yield curve analysis is carried. Web each forward date has an associated discount factor that represents the value today of a hypothetical payment that one would receive on. Calculate Discount Factor From Yield Curve.

From khatabook.com

Know About Discount Factor Meaning, Formula and Calculation Calculate Discount Factor From Yield Curve Web another way to calculate implied spot and forward rates is with discount factors. Web the discount factor for a given period will equal the sum of the atomic prices for that period. Dr = discount rate ; Where, df = discount factor ; Web these formulas are used below to calculate the yield on a discount bond when the. Calculate Discount Factor From Yield Curve.

From blog.deriscope.com

Parametric Yield Curve Fitting to Bond Prices The NelsonSiegel Calculate Discount Factor From Yield Curve This follows because the purchase. Web another way to calculate implied spot and forward rates is with discount factors. Web each forward date has an associated discount factor that represents the value today of a hypothetical payment that one would receive on the forward. Dr = discount rate ; Web the discount factor can be calculated using the discount rate. Calculate Discount Factor From Yield Curve.

From es.scribd.com

Discount Factors Table PDF Economics Corporate Law Calculate Discount Factor From Yield Curve This follows because the purchase. Web the discount factor for a given period will equal the sum of the atomic prices for that period. Dr = discount rate ; Web these formulas are used below to calculate the yield on a discount bond when the relevant discount factor is known and to. Web the question is, how can i now. Calculate Discount Factor From Yield Curve.

From studylib.net

Yield Curve Calculations Calculate Discount Factor From Yield Curve Web the discount factor can be calculated using the discount rate as follows: Web the question is, how can i now obtain the zero rate curve once the discount factors are known? Web each forward date has an associated discount factor that represents the value today of a hypothetical payment that one would receive on the forward. Web the discount. Calculate Discount Factor From Yield Curve.

From www.youtube.com

ANNUITY FACTOR IN NPV SUM OF DISCOUNTING FACTOR FOR COMMON NBs YouTube Calculate Discount Factor From Yield Curve Where, df = discount factor ; Dr = discount rate ; Web each forward date has an associated discount factor that represents the value today of a hypothetical payment that one would receive on the forward. Web the discount factor can be calculated using the discount rate as follows: Web the question is, how can i now obtain the zero. Calculate Discount Factor From Yield Curve.

From www.youtube.com

How to Calculate Discounting Factors? Financial Management YouTube Calculate Discount Factor From Yield Curve Dr = discount rate ; In fact, this is how yield curve analysis is carried. Df = 1 / (1 + dr)^t. Web these formulas are used below to calculate the yield on a discount bond when the relevant discount factor is known and to. Web each forward date has an associated discount factor that represents the value today of. Calculate Discount Factor From Yield Curve.

From www.mdpi.com

IJFS Free FullText On the Choice of the Discount Rate and the Role Calculate Discount Factor From Yield Curve In fact, this is how yield curve analysis is carried. Web another way to calculate implied spot and forward rates is with discount factors. Df = 1 / (1 + dr)^t. Web each forward date has an associated discount factor that represents the value today of a hypothetical payment that one would receive on the forward. Web these formulas are. Calculate Discount Factor From Yield Curve.

From www.youtube.com

Simple discount rate calculation YouTube Calculate Discount Factor From Yield Curve This follows because the purchase. Web the discount factor can be calculated using the discount rate as follows: Where, df = discount factor ; Web another way to calculate implied spot and forward rates is with discount factors. In fact, this is how yield curve analysis is carried. Web the discount factor for a given period will equal the sum. Calculate Discount Factor From Yield Curve.

From adysonancepruitt.blogspot.com

How to Calculate Yield AdysonancePruitt Calculate Discount Factor From Yield Curve Df = 1 / (1 + dr)^t. Where, df = discount factor ; Web each forward date has an associated discount factor that represents the value today of a hypothetical payment that one would receive on the forward. This follows because the purchase. Web these formulas are used below to calculate the yield on a discount bond when the relevant. Calculate Discount Factor From Yield Curve.

From www.quantandfinancial.com

Quantitative & Financial Treasury Yield Curve Bootstrapping Calculate Discount Factor From Yield Curve Web each forward date has an associated discount factor that represents the value today of a hypothetical payment that one would receive on the forward. In fact, this is how yield curve analysis is carried. Web the discount factor can be calculated using the discount rate as follows: Web the discount factor for a given period will equal the sum. Calculate Discount Factor From Yield Curve.

From granteshita.blogspot.com

Current bond price formula GrantEshita Calculate Discount Factor From Yield Curve Web another way to calculate implied spot and forward rates is with discount factors. Dr = discount rate ; Web the discount factor can be calculated using the discount rate as follows: Web the question is, how can i now obtain the zero rate curve once the discount factors are known? Web the discount factor for a given period will. Calculate Discount Factor From Yield Curve.

From analystprep.com

Spot, Forward, and Par Rates AnalystPrep FRM Part 1 Study Notes Calculate Discount Factor From Yield Curve Df = 1 / (1 + dr)^t. Web the discount factor for a given period will equal the sum of the atomic prices for that period. This follows because the purchase. Web another way to calculate implied spot and forward rates is with discount factors. Dr = discount rate ; Web the question is, how can i now obtain the. Calculate Discount Factor From Yield Curve.

From asmamanalyaa.blogspot.com

Average tax rate calculator AsmaManalyaa Calculate Discount Factor From Yield Curve This follows because the purchase. Web the question is, how can i now obtain the zero rate curve once the discount factors are known? In fact, this is how yield curve analysis is carried. Dr = discount rate ; Web each forward date has an associated discount factor that represents the value today of a hypothetical payment that one would. Calculate Discount Factor From Yield Curve.